Insurance investment is one of the wisest ways to lower your tax liabilities. As per the provisions of the IT Act, of 1961, you can claim a significant amount of tax deduction from your taxable income. Certain life insurance maturity incomes even qualify for tax exemptions. Therefore, you need to be aware of these provisions beforehand to make a smart tax-saving investment strategy.

This article highlights certain important sections of the IT Act, that allow such tax savings through insurance investments:

- Section 80C

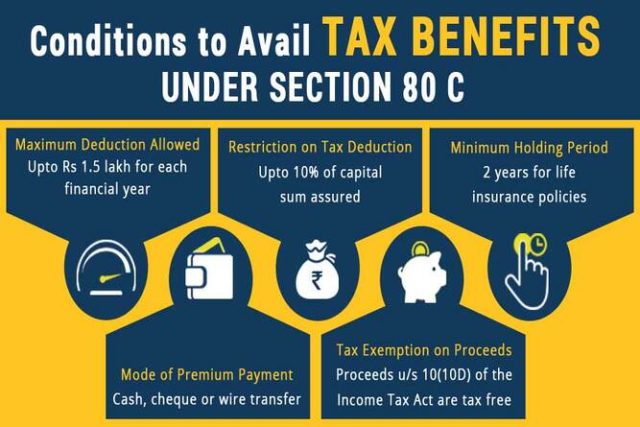

As per the provisions of this section of the IT Act, you are allowed to claim a tax deduction for the premiums paid for life insurance investment from your declared taxable income. The deduction limit is capped at 10% of the total premium paid or the minimum capital sum assured, whichever is the minimum. Moreover, the optimum deduction limit that is permitted under this Section stands at INR 150000.

- Section 80CCC

This is a comparatively lesser-known provision, but highly favourable for pension plan holders. If you are investing in any pension plan insurance policy, you are eligible to claim a deduction of up to INR 150000 for the premiums paid. However, if you surrender the plan, or receive any annuity benefit or pensions, those become taxable under the existing tax laws.

- Section 80CCE

This particular Section specifies that the entire tax deduction limit under Sections 80CCC, 80C, and 80CCD (1) stands at INR 150000.

- Section 80D

This Section exclusively deals with tax benefits through health insurance investments. The concerned health policy(s) must ideally cover self, spouse, dependent children, and parents. For covering self, spouse, and dependent children, the tax deduction limit is INR 25000; if the age of the insurance holder is 60 years or above, then the tax deduction limit is INR 50000. You can claim an additional deduction amounting up to INR 25000, for health insurance covering your parents too. Moreover, if the age of the concerned insured person is 60 years or above, then this limit is INR 50000.

Deductions

80C and 80CCC

- HUFs and individuals can avail of this benefit

- The tax deductions remain limited to premiums up to 20% of the total sum assured, even if the premium value exceeds the limit in a single financial year

- Only 10% of the actual guaranteed capital sum is deducted for insurance plans that are established on or after 1st April 2012. In the case of any severe disability of the concerned individual or any specific ailment, this limit rises to 15%

- If the concerned policy gets cancelled to exist within 5 years for ULIP products and 2 years for traditional insurance products, since the beginning of the plan, all the above-mentioned benefits will be automatically reversed

- You can claim an optimum INR 150000 of tax deduction under Sections 80C and 80CCC

80D

- Both individuals and members of HUFs are eligible to claim this benefit

- This allows a maximum deduction of INR 25000 for health insurance covering self, spouse, and dependent children. It rises to INR 50000 if it covers parents too. Within this specified limit, you can expend towards preventive health check-ups.

80DD

- The deductible limit for any physically impaired dependent amounts to INR 75000/year. For any individual with any grave disability(s), this limit rises to INR 100000.

Exemptions

Section 10 (10D)

If you receive any income from any life insurance plan, including a bonus, it remains tax-free. However, it is inapplicable:

- Any sum received u/s 80DD(3)

- Any sum received under Keyman insurance

- Any sum received due to death benefit for any insurance issued on/after 1st April 2003 and before 31st March 2012, if the total premium received during the apn does not cross 20% of the total guaranteed sum assured

Conclusion

This comprehensive article aptly highlights all the important aspects of tax saving through insurance investments.